Institutional Infrastructure for Onchain Debt Capital Markets

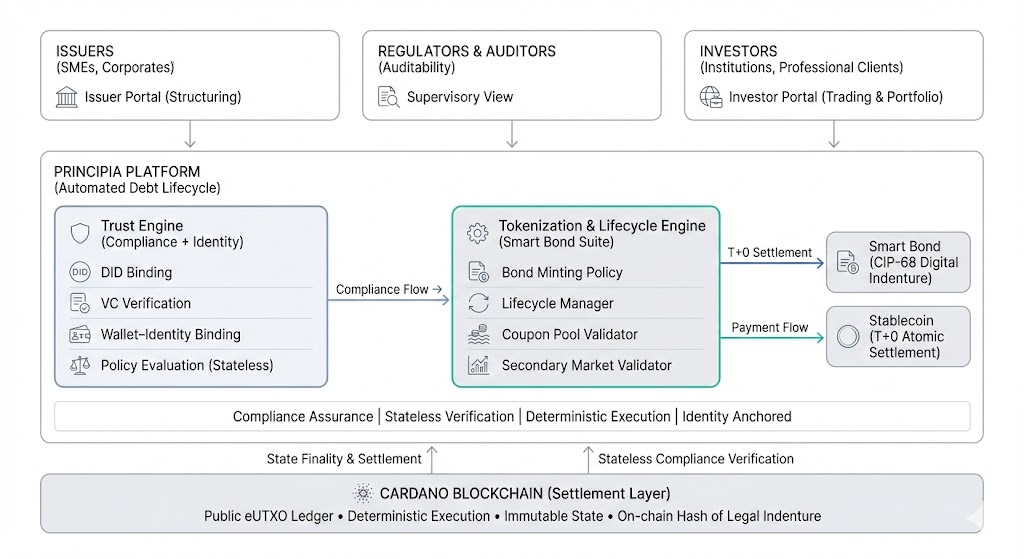

Principia is a Cardano-native protocol that rebuilds the infrastructure layer for debt capital markets—allowing issuers, investors, and regulators to operate on a single, automated, compliance-verified environment.

Executive Summary

The global debt market is a $145 trillion system running on fragmented, reconciliation-heavy infrastructure. Even where individual banks have digitized internal functions, the issuance and lifecycle management of bonds still requires manual workflows, PDFs, and multiple intermediaries. Settlement remains T+2 to T+5, limiting liquidity and creating high operational cost.

For emerging-market SMEs, this cost of access is prohibitive. The GCC alone has an estimated $250B SME financing gap, despite growth initiatives such as Numou (Saudi Arabia) and UAE enterprise programmes, all seeking scalable, transparent, and lower-cost debt channels.

Principia is a Cardano-native protocol that rebuilds the infrastructure layer for debt capital markets—allowing issuers, investors, and regulators to operate on a single, automated, compliance-verified environment. Using decentralized identity, verifiable credentials, and a modular Smart Bond standard, Principia enables T+0 settlement, automated coupon payments, and real-time compliance—without replacing existing market participants like arrangers, legal counsel, or auditors.

Principia is currently preparing a live pilot inside ADGM’s RegLab sandbox (Q4 2025) with 2–3 UAE-based SME issuers.

The Problem

Legacy Infrastructure Blocks Innovation

The existing bond issuance stack is fragmented across arrangers, custodians, registrars, paying agents, and compliance teams. Each maintains its own siloed system, requiring constant reconciliation. This causes:

- Slow settlement (T+2–T+5) — trapping capital and reducing liquidity.

- High issuance cost — making public markets inaccessible to SMEs.

- Manual compliance & reporting — increasing regulatory burden and operational risk.

- Inability to integrate with modern digital identity frameworks.

Tokenization alone does not solve this problem. Wrapping old processes in a digital asset simply inherits the original inefficiencies.

Principia Solution

Principia provides end-to-end lifecycle automation for digital bonds on Cardano, built around two core components:

A. Principia Trust Engine (Compliance + Identity Layer)

(Whitepaper reference: Identity, VC-in-Redeemer, Verifiable Smart Contracts)

The Trust Engine embeds identity at the protocol layer using DID/VC standards and verifiable smart contracts. It allows issuers, investors, and service providers to interact through:

- DID Binding — linking legal entities to cryptographic identities.

- VC Verification — real-time KYC/AML and eligibility checks.

- Stateless Policy Evaluation — enforcing compliance rules without revealing sensitive data.

- Regulatory Visibility — regulators access supervisory views without custodying user data.

This turns compliance into an automated, privacy-preserving, protocol-level primitive.

B. Tokenization & Lifecycle Engine (Smart Bond Suite)

(Whitepaper reference: CIP-68 Digital Indenture, Lifecycle Manager, Coupon Validators)

Principia’s lifecycle engine standardizes the entire bond lifecycle:

- Bond Minting Policy — CIP-68 on-chain indenture with metadata + legal hashes.

- Lifecycle Manager — automated accruals, coupon events, and redemptions.

- Coupon Pool Validator — deterministic distribution to eligible holders.

- Secondary Market Validation — compliant peer-to-peer trading.

- T+0 Atomic Settlement using stablecoins.

Together, these modules replace thousands of manual steps with deterministic execution.

Why Cardano?

Cardano’s eUTxO ledger provides deterministic settlement, native multi-asset support, and parallel global state—ideal for regulated financial workflows. Smart Bonds on Cardano are predictable, transparent, and easily auditable. The platform’s decentralized identity frameworks align with global regulations (GLEIF vLEI, W3C VCs), creating a natural foundation for regulated capital markets.

Market & Timing

- $145T Global Bond Market — minimal on-chain penetration.

- GCC Sovereign & Corporate Debt Boom — rapid growth, regulatory modernization, and adoption of fintech sandboxes.

- SME Financing Push — initiatives like Numou, TDF (Saudi), and UAE enterprise programs are actively seeking digital rails.

- Regulators moving toward verified digital identity — ADGM, FSRA, and VARA accelerating digital asset regulatory clarity.

Principia addresses immediate institutional needs while enabling long-term capital market modernization.

Go-to-Market (Phased Rollout)

Phase I

ADGM Sandbox (Q4 2025)

- 2–3 SME issuers (Abu Dhabi + Dubai)

- Digital indenture structuring

- T+0 settlement pilot

- Formal validation of Trust Engine and Smart Bond Suite

Phase II

Expansion (2026)

- VARA + DIFC licensing

- SME bond & corporate note issuance

- Launch of Principia Yield Index

- Integrations with arrangers, custody, and auditors

Phase III

Scaling (2026–2027)

- GCC-wide deployment

- Sovereign/quasi-sovereign pilot

- Deep DeFi liquidity integration

- Global institutional connectivity

Business Model

Principia follows a B2B2X protocol model, aligning economics with market participants:

- Issuance Fee (bps on principal) — low-cost access for SMEs.

- Lifecycle Servicing Fee (bps on AUM) — automated coupon + reporting.

- Platform licensing for financial institutions — arrangers, custodians, auditors.

- Future revenue: yield indices, market data, and analytics.

This model mirrors the existing value chain rather than displacing it—supporting adoption from regulated stakeholders.

Vision

Principia aims to become the operating system for on-chain debt, where every issuance, investor, and regulator interacts through a unified, compliant digital infrastructure. By combining decentralized identity, deterministic execution, and regulatory alignment, Principia brings institutional-grade capital market infrastructure onto an open blockchain.